Business environments are constantly evolving, demanding organizations to be agile and adaptable. In the face of this change, financial processes often become complex and time-consuming, hampering business growth. The solution lies in Agile Finance, which, when complemented by Business Process Automation, can streamline operations and set a firm foundation for success.

Understanding Agile Finance

Agile Finance is a modern approach to financial management that emphasizes flexibility, speed, and efficiency. It deviates from traditional finance models that are often rigid and slow to adapt to change. Agile Finance leverages technology and data-centric strategies to facilitate quick and informed decision-making. It is about being responsive and proactive, rather than reactive and passive.

However, the implementation of Agile Finance can be a challenging task. It involves changing the organizational culture, restructuring processes, and adopting innovative technologies. This is where Business Process Automation comes into play.

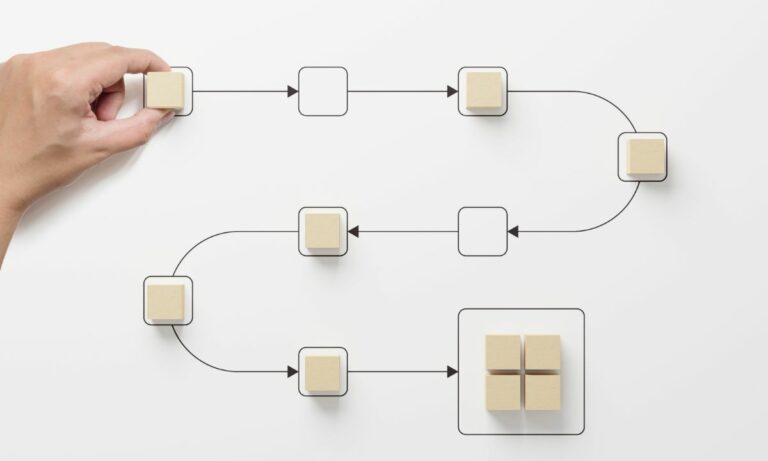

By automating financial processes, businesses can remove unnecessary manual work, reduce errors, and increase efficiency. This is critical for agility, as it allows finance teams to focus on strategic tasks and decision making, rather than getting bogged down in day-to-day operations.

The Role of Business Process Automation in Agile Finance

Business Process Automation (BPA) is a key enabler of Agile Finance. It allows businesses to streamline their financial processes, making them quicker, more accurate, and less labor-intensive. BPA uses technology to automate routine tasks, reducing the risk of human error and freeing up staff time for more strategic work.

For example, BPA can be used to automate invoice processing, expense reporting, budgeting, and financial forecasting. This not only improves efficiency but also provides real-time visibility into financial data, aiding in better decision making.

Agile Finance Transformation: A Strategic Approach

The concept of Agile Finance Transformation is gaining traction as businesses seek to adapt in the rapidly changing economic landscape. This transformation is about more than just the adoption of new technologies or methodologies; it is a holistic change that impacts people, processes, and technology to create a more dynamic and responsive finance function.

An agile finance team is at the heart of this transformation, working collaboratively to implement agile principles and practices. Such a team is cross-functional, highly skilled, and empowered to make decisions swiftly, which is crucial for responding to market changes and emerging business opportunities.

By embracing Agile Finance Transformation, companies can create a competitive edge that allows them to anticipate and respond to challenges more effectively. This strategic approach aligns the finance function with the broader business goals, ensuring a cohesive and proactive stance towards financial management.

Reaping the Benefits of Agile Finance and Business Process Automation

By combining Agile Finance and Business Process Automation, your business can reap numerous benefits. Firstly, it can significantly reduce the time spent on routine financial tasks, allowing your finance team to focus on strategic initiatives.

Secondly, it can improve the accuracy of financial data, reducing the risk of costly errors. This can be particularly beneficial for businesses that handle large volumes of financial transactions.

Lastly, it can provide real-time visibility into financial performance, enabling quicker and more informed decision-making. This is crucial for maintaining financial stability and driving business growth in a volatile market.

In conclusion, Agile Finance and Business Process Automation are powerful tools that can transform your financial management, driving efficiency, accuracy, and strategic decision-making. By embracing these techniques, you can reinvent your business for a successful future.

Ready to experience the power of business process automation in your financial processes? Schedule a free demo of Flokzu and see how it can revolutionize your business operations.