Change is the only constant in the world of business. It is particularly true for industries like mortgage management where accuracy, compliance, and speed are of utmost importance. Revolutionizing your business with mortgage management automation can be the game-changer that will put you ahead of the competition.

Understanding Mortgage Management Automation

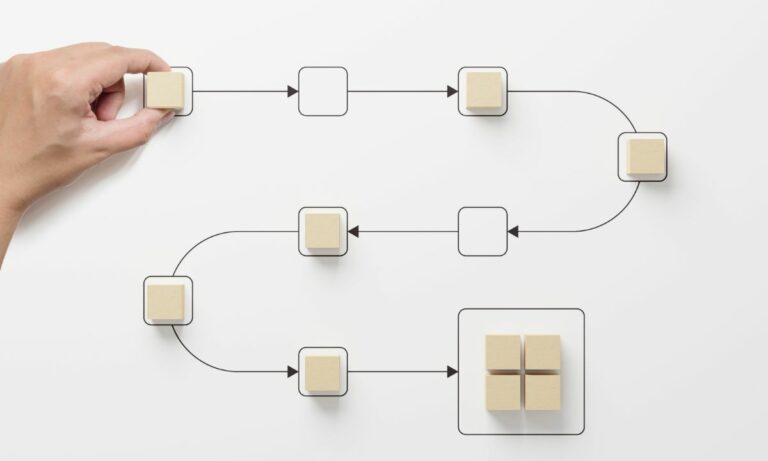

Mortgage management automation involves the utilization of technology to streamline and automate repetitive and time-consuming tasks, thereby increasing efficiency, reducing errors, and improving customer satisfaction. This includes everything from loan origination to underwriting, closing, and even post-closing tasks.

With mortgage management automation, accuracy is significantly improved. As tasks are automated, the risk of manual errors is significantly reduced. Consequently, compliance is improved since automated systems are designed to adhere to the latest regulatory standards.

Moreover, automation enhances speed. Time-consuming tasks that used to take hours can now be completed within minutes. This results in a quicker turnaround time, facilitating faster decision-making and improved customer service.

Why Mortgage Management Automation is a Game-Changer

Automation has the potential to revolutionize the mortgage industry. It does so by bringing several game-changing benefits, some of which are highlighted below:

- Increased Efficiency: Automation eliminates redundant tasks, enabling employees to focus on more strategic activities.

- Improved Accuracy: Automated systems are less likely to make errors, ensuring accurate data and reliable outcomes.

- Enhanced Compliance: Automation guarantees adherence to regulations, reducing the risk of non-compliance and associated penalties.

- Improved Customer Experience: With faster processes and less room for error, customer satisfaction is greatly enhanced.

Given these benefits, it is clear that mortgage management automation is no longer a luxury but a necessity for businesses looking to stay competitive in the modern landscape.

Automate with Flokzu

While the idea of automation may seem daunting, Flokzu makes the process easy and efficient. Flokzu offers a comprehensive solution for automating business processes, including mortgage management. With Flokzu, you can automate your workflows, streamline tasks, and improve productivity, all while ensuring compliance and accuracy.

Moreover, Flokzu’s pricing is designed to suit businesses of all sizes. Whether you are a small business just starting with automation or a large enterprise looking to optimize your processes further, Flokzu has a plan that will fit your budget and meet your needs.

By choosing Flokzu, you are not just adopting a tool but partnering with a team of experts committed to helping you revolutionize your business through automation. With Flokzu, you can transform the way you do business, making it more efficient, accurate, and customer-centric.

Are you ready to revolutionize your business with mortgage management automation? Schedule a free demo of Flokzu today and experience the transformation first-hand. Let Flokzu be the game-changer in your business journey.