Companies of all sizes are always looking for ways to maximize their profits and reduce their costs. One of the most significant expenses for businesses is taxes. However, in recent years, large companies have discovered a surprising way to boost their profits significantly: tax automation. In this article, we will delve into how big companies use tax automation to skyrocket their profits and why business process automation is a critical component of this strategy.

The Power of Tax Automation

So, what is tax automation, and why is it so impactful? Tax automation involves using software to automate various tax-related tasks, such as calculating tax liabilities, preparing tax returns, and even determining the optimal tax strategies. The benefits of tax automation are clear: it minimizes human error, ensures compliance with tax regulations, and saves invaluable time and resources that can be better utilized elsewhere.

Moreover, as tax regulations become more complex and change frequently, trying to keep up manually can prove to be a daunting task. Tax automation software is constantly updated to reflect these changes, ensuring that businesses are always in compliance and not exposed to unnecessary risks or penalties.

Big companies, in particular, stand to benefit the most from tax automation. These entities often have operations in multiple jurisdictions, each with its tax laws and regulations. Without automation, managing tax matters for such companies would be nearly impossible and extremely costly. Tax automation simplifies and streamlines this process, resulting in substantial cost savings and increased profits.

Enhancing Tax Strategies with Automation

One way that automation allows producers to use more sophisticated tax strategies is by enabling them to analyze vast amounts of data quickly and accurately. This level of analysis can uncover opportunities for tax savings that might otherwise go unnoticed. By leveraging advanced algorithms and machine learning capabilities, tax automation tools are able to suggest strategies that align with current regulations while optimizing tax liabilities.

Role of Business Process Automation

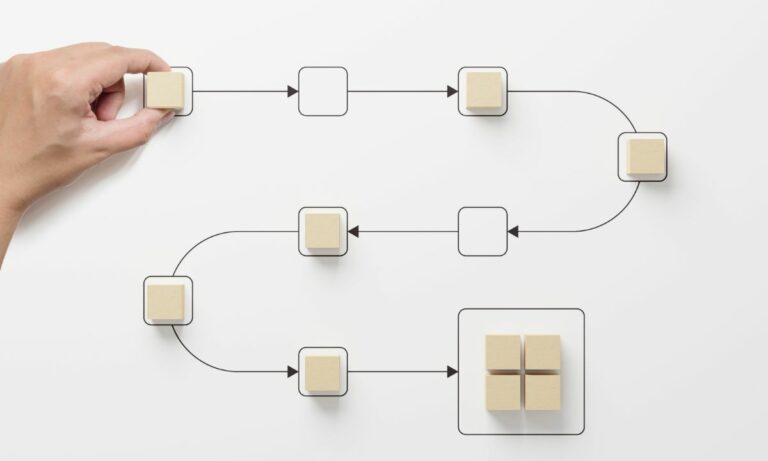

The role of business process automation in tax automation cannot be overstated. Business process automation involves using technology to automate complex business processes, such as procurement, invoicing, and, indeed, taxation. By automating these processes, businesses can significantly reduce their operational costs, increase their efficiency, and improve their bottom lines.

Furthermore, business process automation allows for better visibility and control over the business processes. This is particularly important for tax processes where businesses need to ensure that they are in compliance with all relevant tax laws and regulations.

Take, for example, Flokzu, a business process automation solution provider. Flokzu offers an easy-to-use, cloud-based platform that helps businesses automate their processes, including tax processes. By leveraging Flokzu’s solution, businesses can ensure accuracy, compliance, and efficiency in their tax operations. This, in turn, leads to significant cost savings and increased profits.

Automation Allows Producers to Use More Resources Efficiently

In addition to tax benefits, automation allows producers to use more of their resources efficiently. By minimizing the time and manpower required for tax compliance, companies can allocate more resources towards innovation, product development, and expansion strategies. This holistic approach to automation not only enhances profitability through tax savings but also fosters an environment that supports business growth and competitive advantage.

Conclusion

In conclusion, the shocking truth is that big companies are leveraging tax automation to significantly boost their profits. With the help of business process automation solutions like Flokzu, these companies are able to automate their tax processes, ensuring accuracy, compliance, and efficiency. This not only results in substantial cost savings but also helps these companies to stay competitive in today’s fast-paced business environment.

If you too want to reap the benefits of tax automation and business process automation, it’s time to take action. Opting for a robust automation solution can be a game-changer for your business. To make this decision easier, we recommend visiting our pricing page to understand which plan best suits your needs.

Why wait? It’s time to take the leap and transform your business processes. Schedule a free consultancy with Flokzu today and discover how we can help your business skyrocket its profits through automation.