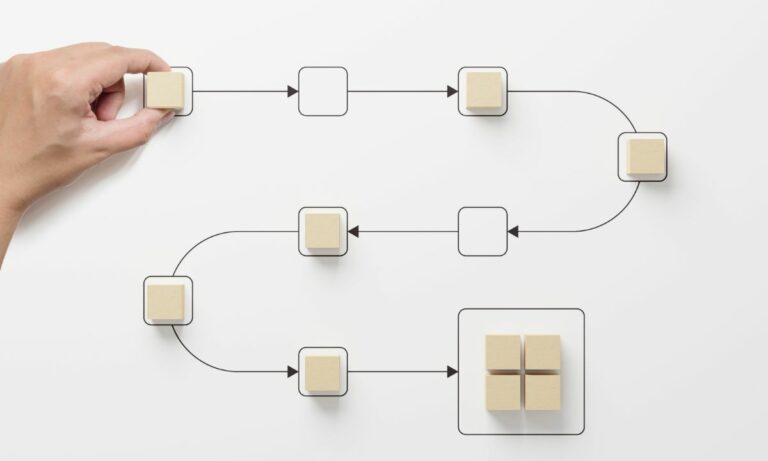

When it comes to running a successful business, efficiency is the name of the game. As businesses grow and expand, the complexities of their operations tend to increase, leading to a heightened risk of inefficiencies and errors. This is where Business Process Management (BPM) comes into play. BPM is a systematic approach to making an organization’s workflow more effective, efficient, and capable of adapting to an ever-changing environment. It is imperative in mitigating financial risks and optimizing the overall business performance.

As an expert in this field, I can attest to the transformative power of BPM. Not only does it streamline your processes, but it also significantly reduces the risk of costly errors. This guide aims to provide you with a comprehensive understanding of how BPM can help you in mitigating financial risks.

Moreover, it’s worth noting that BPM is not a one-time task but a continuous process of identifying, evaluating, and improving your business processes. This continuous improvement is what makes BPM a powerful tool for any business aiming to stay competitive and profitable in today’s fast-paced market.

The Role of BPM in Financial Risk Mitigation

The financial aspect of every business is like its lifeblood. Any issues or errors in financial processes can lead to significant losses and even bankruptcy. Hence, managing financial risks is crucial. BPM plays a pivotal role in this regard.

By automating and optimizing financial processes, BPM reduces the risk of errors and fraud. It ensures accurate data recording and processing, timely reporting, and compliance with financial regulations. BPM solutions like Flokzu provide powerful tools for process automation, reducing the need for manual intervention and the associated risks.

Besides, BPM also helps in identifying and mitigating potential risks in advance. It allows for real-time monitoring of processes and alerts if there’s any deviation from the standard procedure or any potential risk looming around. This proactive approach to risk management is what makes BPM an invaluable asset for any business.

How Flokzu Can Help

Now that we understand the importance of BPM in mitigating financial risks, let’s delve into how Flokzu, a leading provider of BPM solutions, can assist you in this journey. Flokzu offers a robust and user-friendly platform for automating and managing your business processes.

The platform provides tools for workflow automation, real-time monitoring, and analytics, among others. These tools not only help in streamlining your processes but also provide valuable insights for decision-making. By using Flokzu, you can reduce the time spent on repetitive tasks, minimize errors, and focus more on strategic activities that add value to your business.

Moreover, Flokzu offers scalable solutions that grow with your business. Whether you’re a small business or a large enterprise, Flokzu has a suitable plan for you. You can check out the pricing on their website to find a plan that fits your needs and budget.

Conclusion

Financial risk mitigation is a crucial aspect of any business. Without a proper system in place, your business is exposed to a plethora of risks that can lead to financial losses and damage your business reputation. BPM, with its systematic approach to improving business processes, serves as your ally in this endeavour.

By leveraging a BPM solution like Flokzu, you can not only streamline your processes and reduce errors but also gain valuable insights to make informed decisions. It’s a win-win situation for your business. So why wait?

Start your journey towards efficient business process management today. Schedule a free consultancy with Flokzu and discover how you can unleash the power of BPM to mitigate financial risks and optimize your business performance.