When it comes to debt recovery, businesses often struggle with inefficient processes, lack of transparency, and high operational costs. These challenges can lead to reduced productivity, loss of revenue, and a negative impact on customer relationships. However, by leveraging the power of Business Process Management (BPM), businesses can not only streamline their debt recovery processes but also achieve unprecedented success by beginning to automate debt recovery process steps.

As a Business Process Automation expert, I firmly believe in the transformative potential of BPM. It can revolutionize the way businesses operate, making them more efficient, cost-effective, and customer-centric. And when it comes to debt recovery – a critical aspect of any business – BPM can play a pivotal role in optimizing the process, reducing errors, and improving outcomes.

Let’s delve deeper into how unleashing the power of BPM can transform debt recovery for unprecedented success.

Optimizing Debt Recovery with BPM

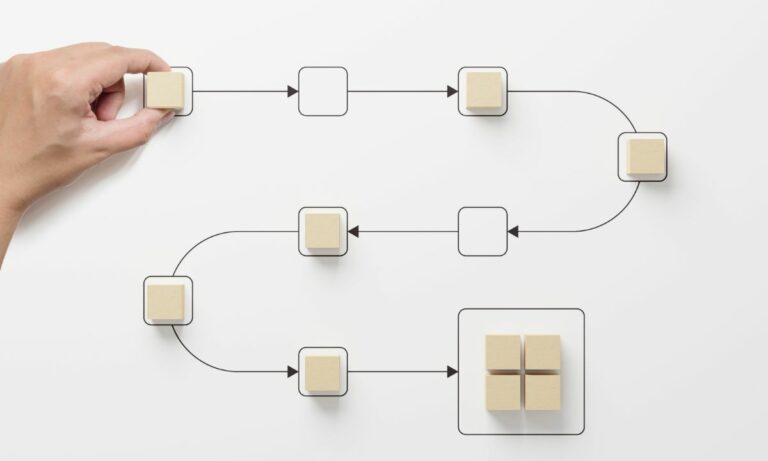

The debt recovery process can be complex, involving multiple steps and stakeholders. It requires careful tracking, timely communication, and meticulous documentation. With traditional methods, it’s easy for things to fall through the cracks, leading to delays, disputes, and lost revenue.

However, with BPM, businesses can automate and streamline these processes, reducing the scope for errors and inefficiencies. BPM tools like Flokzu allow businesses to map out their entire debt recovery process, identify bottlenecks, and automate debt recovery process tasks. This leads to a more efficient and effective process, ultimately boosting the company’s bottom line.

Moreover, BPM also brings greater transparency to the process. With a clear view of the process flow, businesses can better manage their debt recovery efforts, track progress, and make informed decisions. This not only improves operational efficiency but also enhances customer relationships by ensuring timely and accurate communication.

Benefits of Automating Debt Recovery Process

Automating the debt recovery process through BPM offers a host of benefits. Firstly, it significantly reduces the time and effort required to manage the process. By automating repetitive tasks, businesses can free up their resources to focus on more strategic activities.

Secondly, automation brings greater accuracy and consistency to the process. It eliminates the scope for human error and ensures that every step is executed as per the defined process. This not only increases the success rate of debt recovery but also enhances the company’s reputation for professionalism and reliability.

Lastly, automating the debt recovery process also improves customer relationships. With timely and accurate communication, businesses can keep their customers informed about their dues and payment schedules, thereby reducing the chances of disputes and bad debts.

Transform Your Debt Recovery with Flokzu

Flokzu is a leading provider of BPM solutions, helping businesses automate and optimize their processes for enhanced efficiency and productivity. Whether you’re dealing with small debts or large portfolios, Flokzu’s powerful features and intuitive interface make it easy to manage your debt recovery process.

What’s more, Flokzu offers competitive pricing options, ensuring that you get the best value for your investment. With Flokzu, you can automate your debt recovery process, improve outcomes, and drive your business towards unprecedented success.

Ready to transform your debt recovery process with BPM? Schedule a free demo of Flokzu and discover how you can unleash the power of BPM for your business.