Businesses in today’s digital age are constantly seeking ways to optimize their operations, eliminate inefficiencies, and boost their bottom line. One crucial area where this optimization can pay significant dividends is debt recovery. Traditional methods of debt recovery are often time-consuming, labor-intensive, and prone to human error. However, there’s a more efficient and effective solution: business process automation (BPA). By leveraging the power of automation, businesses can transform their debt recovery processes, increasing their recovery rates and reducing their operational costs.

The Power of Business Process Automation in Debt Recovery

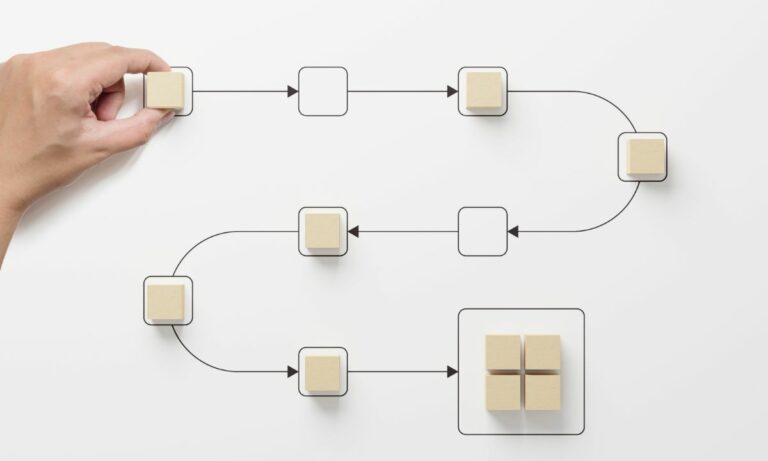

Business Process Automation is a technology-enabled strategy that businesses use to manage their processes. It involves automating routine tasks, streamlining complex business processes, and improving overall efficiency. In the context of debt recovery, automation can play a significant role in enhancing the effectiveness and efficiency of the recovery process.

For starters, automation can help in the swift identification of delinquent debts, facilitating timely intervention. This rapid response can significantly increase the chances of successful debt recovery. Furthermore, automation can improve communication with debtors through automated reminders and notifications, reducing the burden on your staff and ensuring consistent follow-ups.

Automation can also reduce the risk of human error in debt recovery. Manual processes are prone to mistakes, which can lead to incorrect calculations, missed payments, and inconsistent communication. Automation, on the other hand, eliminates these risks, ensuring accuracy and consistency in your debt recovery process.

Integrating Automated Supplier Recovery Processes

Incorporating automated supplier recovery processes into your debt recovery strategy can significantly streamline the way you manage outstanding invoices and supplier-related financial discrepancies. Such automation enables businesses to systematically identify areas where supplier overpayments or under-deductions occur and rectify them without the need for manual intervention. The result is a more robust and reliable debt recovery system that enhances financial control and maximizes revenue recovery.

Unleashing the Power of Business Process Automation with Flokzu

As a B2B company dedicated to business process automation, Flokzu provides an ideal solution for businesses looking to optimize their debt recovery processes. By leveraging Flokzu’s workflow automation capabilities, you can transform your debt recovery process, making it more effective and efficient.

Flokzu’s automation tools allow you to automate the identification of delinquent debts and the management of automated supplier recovery processes, ensuring swift intervention and comprehensive financial oversight. Automated reminders and notifications can also be set up, ensuring consistent communication with debtors and suppliers alike. Additionally, Flokzu’s tools can help eliminate human error in your process, ensuring accuracy and consistency in your debt recovery efforts.

By automating your debt recovery process with Flokzu, you can free up your staff’s time to focus on other important tasks, reduce your operational costs, and increase your recovery rates. Furthermore, Flokzu’s solution is flexible and scalable, allowing it to grow with your business and adapt to your changing needs.

Invest in Business Process Automation Today

Investing in business process automation is a strategic decision that can transform your debt recovery process and yield significant benefits for your business. It can help you streamline your operations, reduce your costs, and improve your recovery rates. And with a platform like Flokzu, getting started with automation has never been easier.

To learn more about how Flokzu can help you unleash the power of business process automation in your debt recovery process, check out our pricing page. Here, you’ll find different plans that cater to businesses of all sizes, ensuring that you get a solution that matches your budget and meets your needs.

Business process automation is no longer a luxury; it’s a necessity for businesses looking to stay competitive in today’s digital age. Don’t let your debt recovery process be bogged down by inefficiencies and errors. Start your journey towards automation today and witness the transformative power of business process automation.

Ready to take the next step towards efficient and effective debt recovery? Schedule a free consultancy with Flokzu and discover how automation can transform your debt recovery process. Take the first step towards a more efficient, effective, and profitable future today.