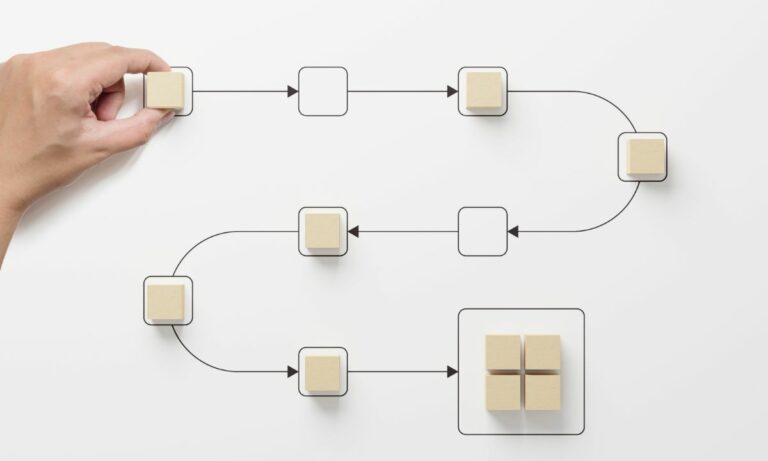

Business Process Automation (BPA) has become a buzzword in the corporate world, and for a good reason. It has revolutionized how businesses operate, leading to increased efficiency, productivity, and cost savings. But the game-changing potential of BPA isn’t realized solely through technology and innovation. Project financing plays a crucial role in unlocking the full potential of BPA. This article will delve into how project financing impacts BPA and why it’s a key factor in achieving success.

The Role of Project Financing in BPA

Project financing is an essential aspect of any business project, including BPA. It involves securing the necessary funds to initiate, manage, and complete the automation project. For businesses looking to streamline their operations, such as an arcade business, financing becomes a strategic move. Arcade business financing can provide the capital needed to invest in the latest gaming technology and business process automation software, ensuring that arcade owners stay competitive in a rapidly evolving industry.

Without adequate financing, businesses run the risk of incomplete or ineffective automation, which can lead to inefficiencies, increased costs, and unmet objectives. Therefore, securing proper project financing is a prerequisite to successful BPA.

Moreover, project financing should not be a one-time event. It should be a continuous process that takes into account the evolving needs of the business, changes in technology, and the dynamic nature of the market. This approach ensures that the BPA project remains relevant and effective in delivering the desired outcomes.

Unlocking Success with the Right Financing and Automation Partner

Finding the right financing solution and automation partner are two key factors that can determine the success of your BPA project. The right financing solution allows you to invest in advanced automation tools and technologies without straining your business finances. It also enables you to keep the project on track and deliver the desired results.

On the other hand, choosing the right automation partner is equally important. An experienced and reliable partner like Flokzu can guide you through the automation process, helping you avoid common pitfalls and ensuring you get the most out of your investment. Flokzu offers a flexible pricing model that suits businesses of all sizes, making BPA accessible and affordable.

Moreover, Flokzu’s expertise extends beyond providing automation solutions. They also offer training and support to ensure your team is well-equipped to use the new systems effectively. This holistic approach to BPA guarantees that the project delivers maximum benefits to your business.

Arcade Business Financing: A Catalyst for BPA Advancement

When it comes to sectors like the entertainment industry, particularly arcade businesses, financing can act as a catalyst for embracing advanced BPA systems. Arcade business financing helps these businesses automate key processes such as inventory management, customer loyalty programs, and sales tracking. This dedicated financial support enables arcade owners to adopt cutting-edge technology that drives efficiency and customer satisfaction.

Conclusion

Project financing is a game-changer in Business Process Automation. It unlocks the potential of BPA, allowing businesses to achieve efficiency, productivity, and cost savings. However, securing the right financing and choosing the right automation partner are crucial in realizing these benefits.

With Flokzu’s flexible pricing model and comprehensive automation solutions, businesses can navigate the BPA journey with confidence and ease. With the right support and resources, you can transform your business processes, driving growth and success.

Are you ready to start your business process automation journey? Automate your first process for free with Flokzu and experience the game-changing impact of project financing in BPA.