Business operations are becoming increasingly complex in our rapidly evolving digital age. Fraud, a long-standing issue, is now more sophisticated, making it crucial for businesses to adapt and innovate. The solution lies in harnessing the power of business process automation. Not only can it streamline your operations, but it can also play a pivotal role in fraud prevention.

As an expert in business process automation, I will share insights on how to leverage this technology to bolster your company’s defenses against fraud. The key lies in understanding the potential of automation, implementing it correctly and adapting it to your unique business needs.

The best part about automation is that it is accessible to businesses of all sizes. Whether you’re a startup or a large corporation, there are automation solutions that can be tailored to your specific needs. Flokzu’s pricing structure, for instance, offers scalable solutions that can grow with your business.

Understanding Business Process Automation

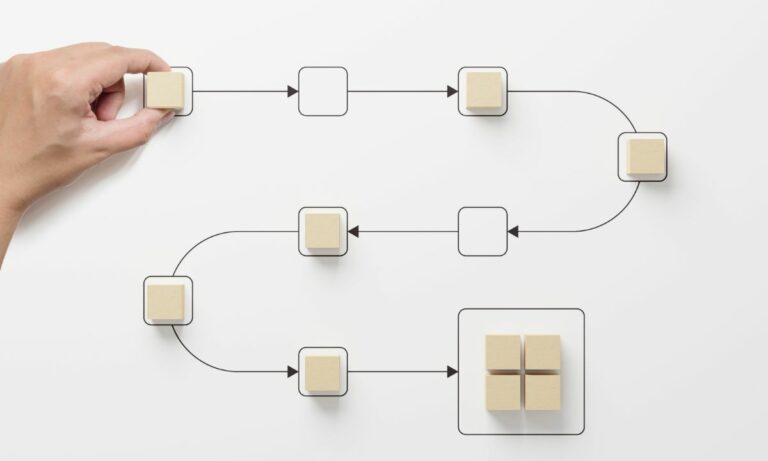

Business process automation, or BPA, is a strategic approach that leverages technology to automate complex business processes. This technology is primarily used to streamline operations, increase efficiency, and reduce costs. However, it also has the potential to significantly enhance fraud detection and prevention strategies.

By automating routine tasks, businesses can focus more on strategic initiatives. This frees up valuable time and resources that can be redirected towards fraud prevention. Moreover, automation reduces human error – a common factor in many fraud cases.

The power of automation lies in its ability to collect, analyze, and manage data more effectively than manual processes. This data-driven approach provides a solid foundation for fraud prevention strategies.

Implementing Business Process Automation for Fraud Prevention

So, how exactly can business process automation be used for fraud prevention? The first step is to identify processes that are vulnerable to fraud. These could be processes that involve financial transactions, sensitive data, or high-risk operations.

Once these processes are identified, they can be automated using BPA tools. These tools can monitor the processes in real-time, identify anomalies, and flag potential fraud risks. This proactive approach can significantly reduce the risk of fraud.

It’s important to remember that automation is not a one-size-fits-all solution. Each business has unique needs and challenges. Therefore, the implementation of BPA for fraud prevention should be customized to fit the specific requirements of your business.

Adapting Automation to Your Business Needs

Adapting business process automation to your specific needs is a critical step in unlocking its full potential. This involves understanding your business processes, identifying areas of vulnerability, and tailoring the automation solution accordingly.

A well-implemented BPA system will seamlessly integrate with your existing operations. It will not only automate tasks but also provide valuable insights that can help improve your overall business strategy. This includes identifying potential fraud risks and implementing preventive measures.

Remember, automation is not just about replacing manual tasks with machines. It’s about leveraging technology to make your business more efficient, more effective, and more resilient against fraud.

To conclude, business process automation can play a powerful role in fraud prevention. Its data-driven approach, real-time monitoring capabilities, and customizability make it an effective tool in combating fraud. However, successful implementation requires a deep understanding of your business processes and a strategic approach to automation.

If you’re ready to unlock the power of business process automation for your business, schedule a free consultancy. Let’s work together to optimize your processes, boost efficiency, and enhance your fraud prevention strategy. The future of your business depends on it.