In an era where technology plays a pivotal role in every industry, the health insurance sector is no exception. With the growing complexity of health insurance management, traditional manual processes are proving to be inefficient and error-prone. The solution lies in harnessing the power of Business Process Management (BPM) to revolutionize health insurance management.

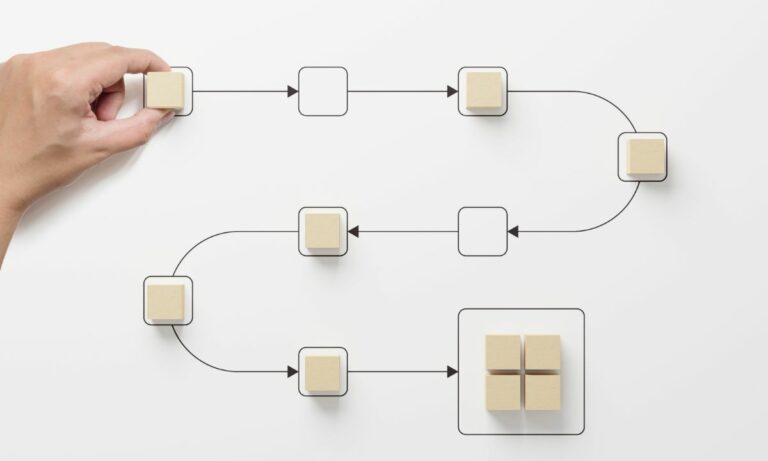

BPM has the potential to streamline operations, improve efficiency, and minimize errors. From processing claims to managing customer queries, BPM can be the driving force behind a more efficient and customer-centric health insurance company.

As an expert in BPM, I strongly advocate its implementation not as an option, but as an essential strategy to remain competitive in today’s digital world. Let’s take a closer look at how BPM is revolutionizing health insurance management.

Streamlining Claims Processing with BPM

One of the most critical aspects of health insurance management is claims processing. Traditional manual processes are time-consuming and prone to errors, leading to delays and customer dissatisfaction. With BPM, claims processing can be automated, improving speed and accuracy.

BPM provides a systematic approach to manage and monitor the entire claims process. It ensures that every stage of the process is performed accurately and within the stipulated time, enhancing customer satisfaction. Moreover, BPM can play a crucial role in fraud detection, saving the company from potential losses.

Implementing BPM in claims processing is a win-win for both the insurance company and the insured. It not only streamlines operations but also improves transparency, leading to higher trust and customer loyalty.

Enhancing Customer Service through BPM

In today’s digital age, customer expectations are higher than ever. They demand quick, accurate, and personalized service. BPM can be a game-changer in meeting these expectations.

By automating customer service processes, BPM ensures that customer queries and complaints are handled promptly and efficiently. It enables real-time tracking of customer interactions, providing valuable insights for improving service quality.

Furthermore, BPM can help in developing personalized health plans based on individual needs and preferences. It allows insurance companies to provide a tailored customer experience, resulting in higher customer satisfaction and retention.

Optimizing Cost Management with BPM

Managing costs is a constant challenge for health insurance companies. With the increasing complexity of health insurance management, controlling costs while maintaining high service quality can be a daunting task. BPM can significantly aid in optimizing cost management.

BPM enables automation of routine tasks, freeing up valuable time and resources. This not only reduces operational costs but also allows staff to focus on strategic initiatives, thereby enhancing overall productivity.

In addition, BPM can provide real-time visibility into process performance, enabling proactive identification and resolution of issues. This can significantly reduce costs associated with process inefficiencies and errors.

In conclusion, BPM is not just a technology; it’s a strategic approach to managing business processes. It’s about harnessing the power of technology to create value for both the insurance company and its customers. And the best part is, you don’t have to do it alone. Companies like Flokzu offer complete BPM solutions tailored to your needs. Check out their pricing for more information.

Whether you’re a small company looking to streamline your operations or a large enterprise aiming to enhance customer service, Flokzu can help you unleash the power of BPM. With Flokzu, you can automate your processes, improve efficiency, and transform your business.

Don’t wait for the future, create it. Schedule a free consultancy with Flokzu today and take the first step towards revolutionizing your health insurance management.