Banco Santander

Banco Santander

Uruguay

Client Profile:

The Santander Group is one of the world’s leading banking and financial services companies. Its main segments are Europe, North America, South America, and Digital Consumer Bank.

In Uruguay, Banco Santander is the leading private Bank in the country, with branches distributed throughout the country.

2020

The year our collaboration began

+200.000

clients

+40

service centers in Uruguay

+800

employees in the country

Context

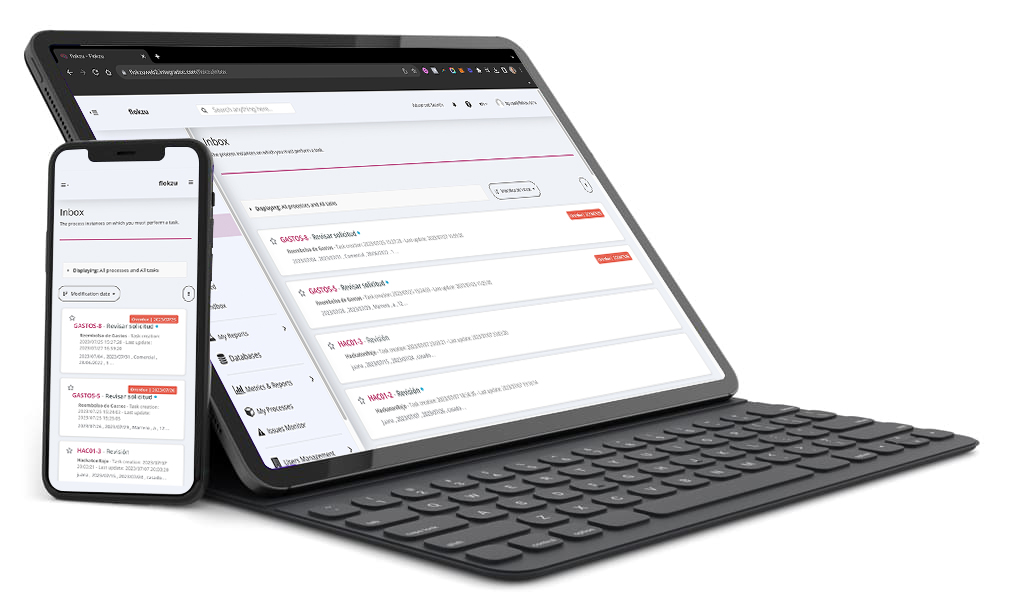

In its constant search for innovation and continuous improvement of its management, in 2020, the Bank decided to move forward with an ambitious program to digitize its operational processes. Santander selected INTEGRADOC (now called Flokzu on-premise) as the Business Process Management (BPM) tool to digitally transform several processes, seeking greater internal efficiency and effectiveness in results. One of the critical attributes that helped us be selected was our tool's low-code / no-code capabilities. This means that Banco Santander could model, automate and deploy its processes without requiring programming and in very little time.

Results achieved

Rapid implementation

In the first 6 months of use, more than 10 complete processes were implemented, reaching an impressive ratio of almost 2 processes per month. An agile methodology was followed, supported by the Bank's professionals, who focused on understanding, modeling, and improving the processes.

Time reduction

For example, in one of the processes involving customers, the time of execution was reduced by 30%, representing a notorious benefit for customers. In addition, it implies a reduction in operating costs and the effort bank employees need to complete these requests.

Digital transformation

Instead of each bank officer having to communicate manually and outside the process with external suppliers, we integrated them 100% digitally. In addition, our software allowed us to send them communications automatically when necessary, eliminating the need to do so manually.

Reduction of tools

The exchange of documentation within the workflow application reduced the use of other communication tools, making it easier to centralize knowledge and documentation in the BPM platform.

Autonomy

Using a low-code / no-code BPM solution allows the IT team to supervise without being actively involved in building the processes. This enables them to fully dedicate themselves to other 100% technological projects requiring specialized knowledge.

The road ahead

Autonomously, the Bank will continue to implement new processes, advancing the entire operation's digitization. This was not a one-off project but the adoption at the corporate level of the discipline of managing, automating, and continuously improving processes.

More success stories